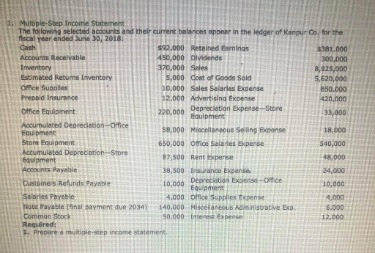

Welcome to High Quality replica watches uk Online Store, Buy the Best Replica Watches in the UK.

At japanwatches.co.uk the High-Quality replica watches for the best price on fake watch website.

At leviswatches.co.uk the High-Quality replica watches for the best price on fake watch website.

As you can see, the interest earned in the example above will continue to grow each year. The longer John keeps his money invested, the faster it will grow. Compounding can help fulfill long-term savings and investment goals, especially if you have time to let it work its magic over years or decades. So, in about 24 years, your initial investment will have doubled. If you’rereceiving 6% then your money will double in about 12 years. You can include regular withdrawals within your compound interest calculation as either a monetary withdrawal or as a percentage of interest/earnings.

Different compounding frequencies

So, for the borrower, the interest rate is the cost of the debt, while for the lender, it is the rate of return. It will help to calculate how much principal needs to be invested to earn a certain amount of interest. If you want to make $5,000 in interest over the next 5 years, this calculation will tell you how much you need to invest. After 10 years, you will have earned $6,486.65 in interest for a total balance of $16,486.65.

What’s the difference between compound interest and simple interest?

Compound interest is calculated by applying an exponential growth factor to the interest rate or rate of return you’re using. The good news is that there are plenty of excellent calculators that will do the math for you. After the first year, you receive a $50 interest payment, but instead of receiving it in cash, you reinvest the interest you earned at the same 5% rate. For the second year, your interest would be calculated on a $1,050 investment, which comes to $52.50. If you reinvest that, your third-year interest would be calculated on a $1,102.50 balance.

- Each of the following tabs represents the parameters to be calculated.

- The first example is the simplest, in which we calculate the future value of an initial investment.

- Specifically, compound earnings refers to the compounding effects of both interest payments and dividends, as well as appreciation in the value of the investment itself.

- Annual Interest Rate (ROI) – The annual percentage interest rate your money earns if deposited.

How does the compound interest rate calculator work?

The continuous compound will always have the highest return due to its use of the mathematical limit of the frequency of compounding that can occur within a specified time period. Most checking accounts from big banks don’t earn interest, but several credit unions and online banks offer checking accounts that accrue compound interest. Compare the best high-yield checking accounts to see what APYs you could earn. A compound interest calculator can help individuals estimate how much they need to save regularly to reach their retirement goals and ensure a comfortable financial future. As shown by the examples, the shorter the compounding frequency, the higher the interest earned.

Calculate your average daily balance

As you can see, the compounding frequency doesn’t make a huge difference, especially not compared to the account’s term. In this case, you’d earn $388.58 in interest on top of your original $5,000 principal deposit, resulting in a total balance of $5,388.58 at the end of the term. To help you remember this, the A in APY stands for annual, so any misconceptions should be cleared up quickly.

Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. We provide answers to your compound interest calculations and show you the steps to find the answer. You can also experiment with the calculator to see how different interest rates or loan lengths can affect how much you’ll pay in compounded interest on a loan.

Compound interest is defined as the interest earned on a loan or investment that comes from both the initial principal and the accumulated interest. We’ve discussed what compound interest is and how it is calculated. So, let’s now break down interest compounding by year,using a more realistic example scenario. We’ll say you have $10,000 in a savings account earning 5% interest per year, withannual compounding. We’ll assume you intend to leave the investment untouched for 20 years.

Future Value (FV), equal to the sum of the initial balance and the surplus. You may choose to set the frequency as continuous, which is a theoretical https://www.business-accounting.net/what-is-cost-insurance-and-freight-cif-for-shipping/ limit of recurrence of interest capitalization. In this case, interest compounds every moment, so the accumulated interest reaches its maximum value.

In this example, the calculator will show you that (compounded monthly), you will need to find an investment that earns at least 11% per year. After the first year, John will earn $100 in interest (10% of the initial investment of $1,000). Since his balance is now $1,100, the interest earned will be $110 (10% of the $1,100).

So, you will earn a total interest of $3,235 and final value will be $8,235 in 10 years. Let’s understand how the compound interest is https://www.quick-bookkeeping.net/ calculated with an example. Compound Interest Calculator lets you know how the power of compounding can amplify your wealth over time.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Take your daily rate of 0.052 percent and your average daily balance of $1,000. CDs can offer better returns than a traditional savings account or money market account, but you’ll still want to calculate how much interest you can earn to evaluate whether a CD is a good choice. Certificates of deposit (CDs) offer some of the best interest rates for an account with little or no financial risk.

Therefore, the more often the interest is added to (capitalized on) the principal amount, the faster your balance grows. While simple interest only earns interest on the initial balance, compound interest earns interest on both the initial balance and the interest accumulated from previous periods. The first example is the simplest, in which we calculate the future value of an initial investment. Note that in the case where you make a deposit into a bank (e.g., put money in your savings account), you have, from a financial perspective, lent money to the bank. As impressive an effect as compound interest has on savings goals, true progress also depends on making steady contributions. Let’s go back to the savings account example above and use the daily compound interest calculator to see the impact of regular contributions.

In this example, we will consider a situation in which we know the initial balance, final balance, number of years, and compounding frequency, but we are asked to calculate the interest rate. This type of calculation may be applied in a situation where you want to determine the rate earned when buying and selling an asset (e.g., property) that you are using as an investment. Many banks compound interest daily, but some compound it weekly, monthly or even quarterly. The more frequently a bank compounds your interest, the faster your money will grow. But depending on your balance and interest rate, the difference between daily and monthly compounding might only be a matter of pennies.

But over a long time horizon, history shows that a diversified growth portfolio can return an average of 6% annually. Investment returns are typically shown at an annual rate of return. The Rule of 72 is a simpler way to determine how long it’ll take for a specific amount of money to attention required! double, given a fixed return rate of return that is compounded annually. It can be used for any investment, as long as there is a fixed rate that involves compound interest. Simply divide the number 72 by the annual rate of return and the result of this is how many years it’ll take.

A much easier and time-saving solution is to use our APY calculator. This finance calculator can be used to calculate the future value (FV), periodic payment (PMT), interest rate (I/Y), number of compounding periods (N), and PV (Present Value). Each of the following tabs represents the parameters to be calculated.